What Is Economic Abuse?

Economic abuse involves maintaining control over financial resources, withholding access to money, or attempting to prevent a victim or survivor from working and/or attending school in an effort to create financial dependence as a means of control. Victims and survivors are often forced to choose between staying in abusive relationships and poverty or even homelessness. Economic abuse is a very common reason victims stay in abusive relationships. Economic abuse can take many forms, including employment-related abuse, preventing the victim from accessing existing funds, coerced debt, and more.

Employment-Related Abuse

Employment-related abuse prevents the victim from earning money by:

- Preventing victim from going to work

- Sabotaging a victim’s employment

- Interfering with a victim’s work performance through harassing activities such as frequent phone calls or unannounced visits

- Demanding that the victim quits her/his job

- Preventing the victim from looking for jobs or attending job interviews

Prevent Victims from Accessing Existing Funds

Abusers also prevent victims from accessing existing funds by:

- Deciding when/how victim can use cash, bank accounts, or credit/debit cards

- Forcing victim to give abuser money, ATM cards, or credit cards

- Demanding that the lease/mortgage or assets be in the abuser’s name

- Using victim’s checkbook, ATM card, or credit/debit cards without the victim’s knowledge

- Preventing victim’s access to bank account(s)

Coerced Debt

Coerced debt refers to non-consensual, credit-related transactions in the context of an abusive relationship. Coerced debt destroy’s the victim’s credit rating, making it difficult for her/him to obtain future loans, rent an apartment and even get a job. Coerced debt includes:

- Applying for credit cards, obtaining loans, or opening other financial accounts in a victim’s name

- Forcing victim to obtain loans

- Forcing victim to sign financial documents

- Use of threats or physical force to convince victims to make credit-related transactions

- Refinancing a home mortgage or car loan without a victim’s knowledge

Other forms of economic abuse include:

- Intentionally withholding necessities such as food, clothing, shelter, personal hygiene products and/or medication

- Refusing to pay court-ordered child or spousal support

- Stealing and/or destroying the victim’s belongings

- Requiring justification for any money spent and punishing the victim with physical, sexual or emotional abuse

- Repeatedly filing costly lawsuits

Six Quick Economic Abuse Statistics

Did you know …

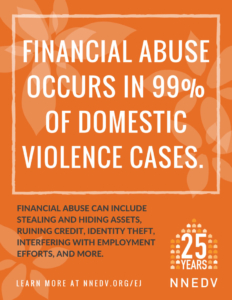

- Between 94-99% of domestic violence survivors have also experienced economic abuse.

- Between 21-60% of victims of intimate partner violence lose their jobs due to reasons stemming from the abuse.

- A survey by the Corporate Alliance to End Partner Violence found that, of respondents who were victims/survivors, 64% reported their abuse impacted their ability to work; 40% reported their abuser harassed them at work via phone and in person.

- Victims of intimate partner violence lose a total of 8 million days of paid work each year, the equivalent of 32,000 jobs.

- Between 2005 and 2006, 130,000 stalking victims/survivors were asked to leave their jobs as a result of their victimization.

- One study found that up to 50% of victims/survivors of sexual assault either lost or left their jobs after being assaulted.

Why Economic Abuse Matters

Victims of domestic violence may be unable to leave an abusive partner or may be forced to return to an abusive partner for economic reasons. Victims of coerced debt may face massive barriers to economic self-sufficiency, including struggling to find a job or even obtaining a place to live after leaving an abusive relationship due to debt and its detrimental effects on their personal credit scores.

What to Do If You Are in an Economically Abusive Relationship

If you are in an abusive relationship and are interested in taking steps towards financial independence, check out the following tips, adapted from Hope & Power for Your Personal Finances: A Rebuilding Guide Following Domestic Violence (also available en Espanol).

- Avoid using credit and debit cards that can enable an abuser to track your whereabouts

- Keep your personal and financial records in a safe location. Leave copies with a trusted friend, relative, or in a bank safety deposit box to which your abuser does not have access.

- Compile an emergency evacuation box with copies of your family’s important records and documents.

- Keep copies of car and house keys, extra money and emergency phone numbers in a safe place.

- If you use the internet to explore domestic violence issues or research how to regain financial independence, make sure your abuser cannot trace your activities.

- Take a financial inventory, listing assets and liabilities.

- If your partner controls the money, look for ways to find out more information about his/her income, financial property, real property and debts.

- If you are considering leaving the relationship, calculate what it would cost you to live on your own, and consider starting to set aside your own money in a safe place, even if it is just a few dollars.

- Obtain a copy of your credit report from any of the three major credit bureaus, review the information, and report any fraud, disputed claims, or identity theft. Under FACTA (The Fair and Accurate Credit Transactions Act) you can obtain a free copy of your credit report every 12 months.

Source: https://ncadv.org/blog/posts/quick-guide-economic-and-financial-abuse